20 Tips to SAVING MONEY FAST

Let’s face it, the past 2 years have been hard on everyone. A lot of people have felt the crunch and that’s why we’re compiling this jam-packed article that will give you 20 tips to saving money fast.

There are probably a lot of reasons why you would like to save up money this year and even for the future.

Be it:

- Saving up for retirement

- Paying off any debt

- Saving up for an emergency fund, or

- Planning for a vacation

Whatever your reason, the information we’ll provide today will save you a few bucks to a couple hundred along the way. In a matter of time, this compounding effect will yield you savings you otherwise would have spent away.

Here are the top 20 Tips to Saving Money Fast

1) Set up Automatic Bill Pay to Avoid Overdraft Fees

Most banking firms have some sort of online banking available which helps in keeping track of your transactions and bill payments. Missing bill payments can lead to the bank slapping you with overdraft fees. Overdraft fees can vary from a few dollars to as much as $35.

Don’t make this simple mistake and set up auto bill pay for your credit cards and loans. We recommend looking at the periods where you get paid from your job and setting up bill pay between this and the time the bill is due.

You want to ensure you have enough funds to cover your bill pay.

2) Ditch the Memberships You Don’t Use

This is a painful take on money that is being simply given away to big corporations while you try to set aside time to utilize such services. This can be your gym memberships, online membership to sites whose services you haven’t used in months, or even special clubs your roommate asked you to join with them.

These dues have to go if you want to get serious about your finances.

3) Don’t Buy Lunch at Work. Take Food from Home Instead

If we all know one thing, its that Americans eat out a lot. Statistics show that around $3,000 a year is spent on eating out. Do yourself a favor when you cook the night before and make an extra serving or two which will allow you to pack food for the next day.

If you’re not up for leftovers, strategize in the morning and get up a few minutes earlier to fix yourself a quick lunch. You can boast about it with your co-workers as they look down on their $8 salad from the corner deli restaurant.

4) Say Goodbye to Cable TV

Cable TV is history compared to the Internet-powered on-demand services that companies like Netflix, Hulu, Sling TV, Amazon Prime Video, HBO Now, and YouTube TV are providing. These services all want a piece of the market share so there is enough competition to keep prices low.

Cable TV can cost upwards of $50 while some of these streaming services start at $7.99 up to $40. That’s enough to cut the cords and say “bye-bye Cable TV!”

5) Inflate Your Tires

If you own any type of motorized vehicle, you will love this money-saving tip. Make sure your tires are inflated up to the manufacturer’s recommended PSI level. Studies have shown that if you drive around with at least 5-10 psi below what your tires should be at, you will have a decreased gas mileage of 5%

Keeping a proper pressure level in your tires in effect leads to better gas mileage. Better gas mileage means lesser trips to the gas station hence saving you money.

6) Cut Your Own Hair

This may seem like a far fetched idea but cutting your hair can really save you a boatload of money. A $30 cut for men’s hair over a 6 month period for the time remaining this year can save you $180. We have been doing this for 3 years already. If you’re up for an adventure, get a clipper set from Amazon. A few cuts and the clipper pays for itself.

If you have someone around the house to help you, we recommend getting another set of eyes to help you get the perfect cut. Watch some YouTube tutorials to help you familiarize yourself with the technique of cutting your hair. You’ll be a pro in no time.

7) Delete All of Your Credit Cards from Online Accounts

This 7th step is easy and simple to do. We’ve all gone through this once at the time of checking out when online shopping. You will see a ‘SAVE YOUR CARD’ option for later use.

This little convenience results in far more spending than what you normally would have spent if not for the ease of hitting buy with one click. We recommend removing your credit card from your accounts and manually entering it when you are ready to really make that purchase!

8) Cook Your Own Food at Home

Cooking food at home will not only make you a better cook, but it will also lead to healthier meal choices and of course, save you the money you would have spent dining out.

The challenges of today’s fast-paced society is that we never get enough time to do things ourselves. Cooking homemade delicious meals have literally been sent out the door. We have chosen to eat fast food because of its convenience and rather ok taste.

What we fail to realize is that not only is the food bad for our health but it costs more. The french fries that cost a $1 to $2 probably came from a potato that you yourself could have bought for half a dollar or less.

If you have a crock-pot, you can easily set it up before you go to work and have a nice meal ready by dinner time. This has helped us recoup so much of the time lost cooking and is on track to saving us some money as we shop our local stores for raw ingredients than going through drive-thrus.

9) Carpool

Have a co-worker that lives nearby and goes the same route you do? Hitch a ride with them and carpool. This popular idea saves you wear and tear on your vehicle and you save on toll and gas expenses.

The same goes for family members. Workaround a time when you can get dropped off and picked up to avoid running your second vehicle around.

10) Cut out the Meat

Well not fully if you’re a meat-lover but this expensive taste in meat can leave you thinking where you spent the last hundred or so. Meat can get expensive fast. Try incorporating more veggies in your diet and cutting down on the meat and you will realize how much of a difference it makes both for your savings and for your health.

Nutritionally, while meat may serve up more protein per ounce as per its counterparts, beans, and greens, it is a lot healthier to eat a vegan diet than to consume meat products. A vegan diet has more fiber, less cholesterol, and antioxidant properties. Plus, a can of beans is cheaper than steak. Try out the Beyond Burger which is 100% plant-based. It tastes just like beef but is made entirely out of plant-based ingredients.

Check out the documentary – What the Health on YouTube.

11) Exercise at Home

Exercising at home can be the best decision to make for your lifestyle. Not only does this routine keep you fit, it saves you costs on gym memberships.

Try getting an exercise resistance band that can help you perform most resistance training right in your living space. Try outdoor walks to get your heart rate going and even perform a yoga mediation without going to a yoga instructor. There are plenty of videos on Yoga at Home

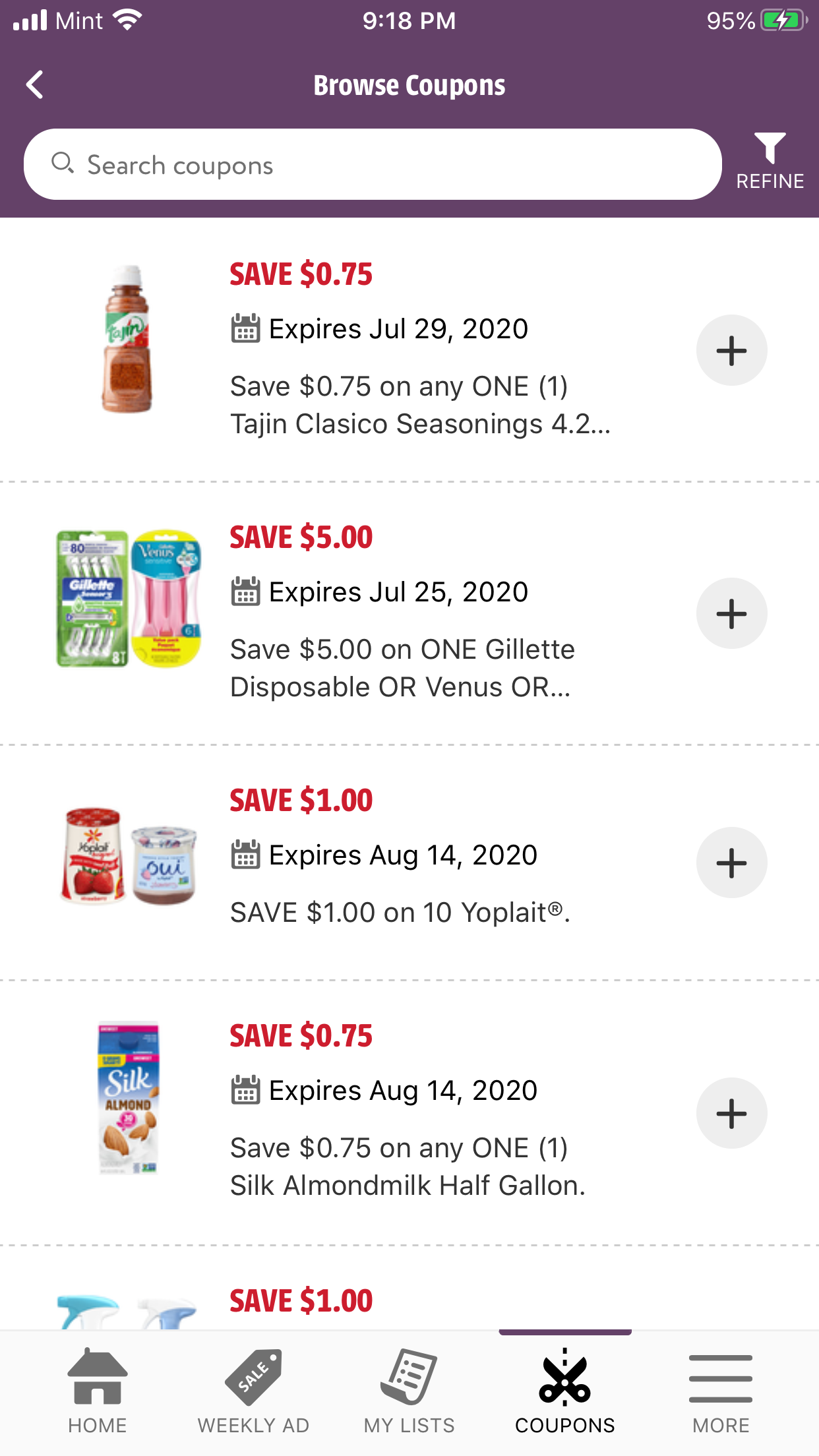

12) Utilize Paper Coupons and Coupon Apps

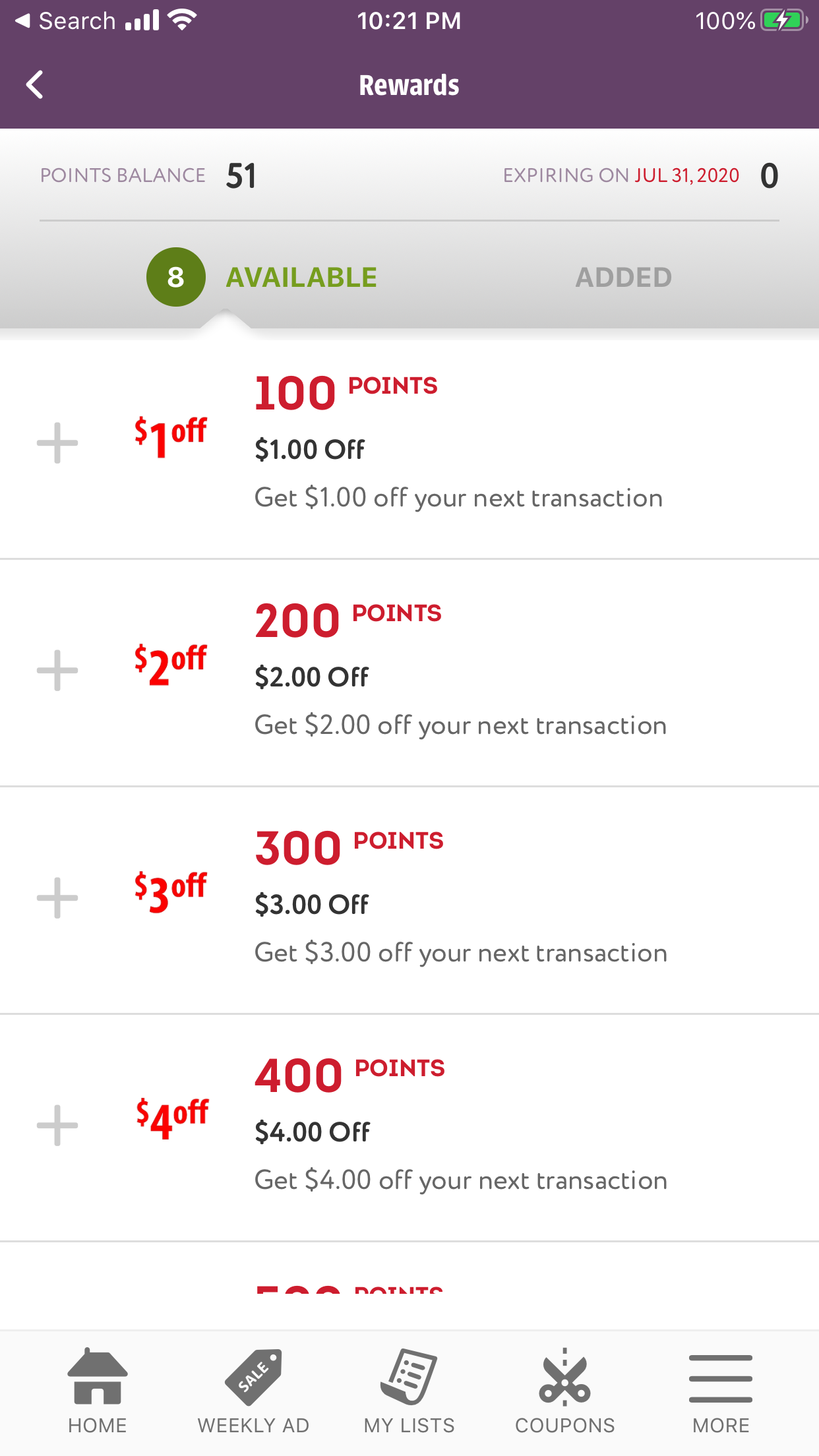

Coupon clipping is not for cheap people. We consider coupon shopping a SMART strategy in making wise financial decisions. Would you rather pay for something knowing you can get $1, $2, or even more off the same item? That seems like a no brainer but people often neglect this strategy when shopping.

See if the supermarkets and store you shop at have an app. These apps usually have reward programs and coupon clipping built in them. Save these coupons to your account and upon checkout, these rewards get applied to your order.

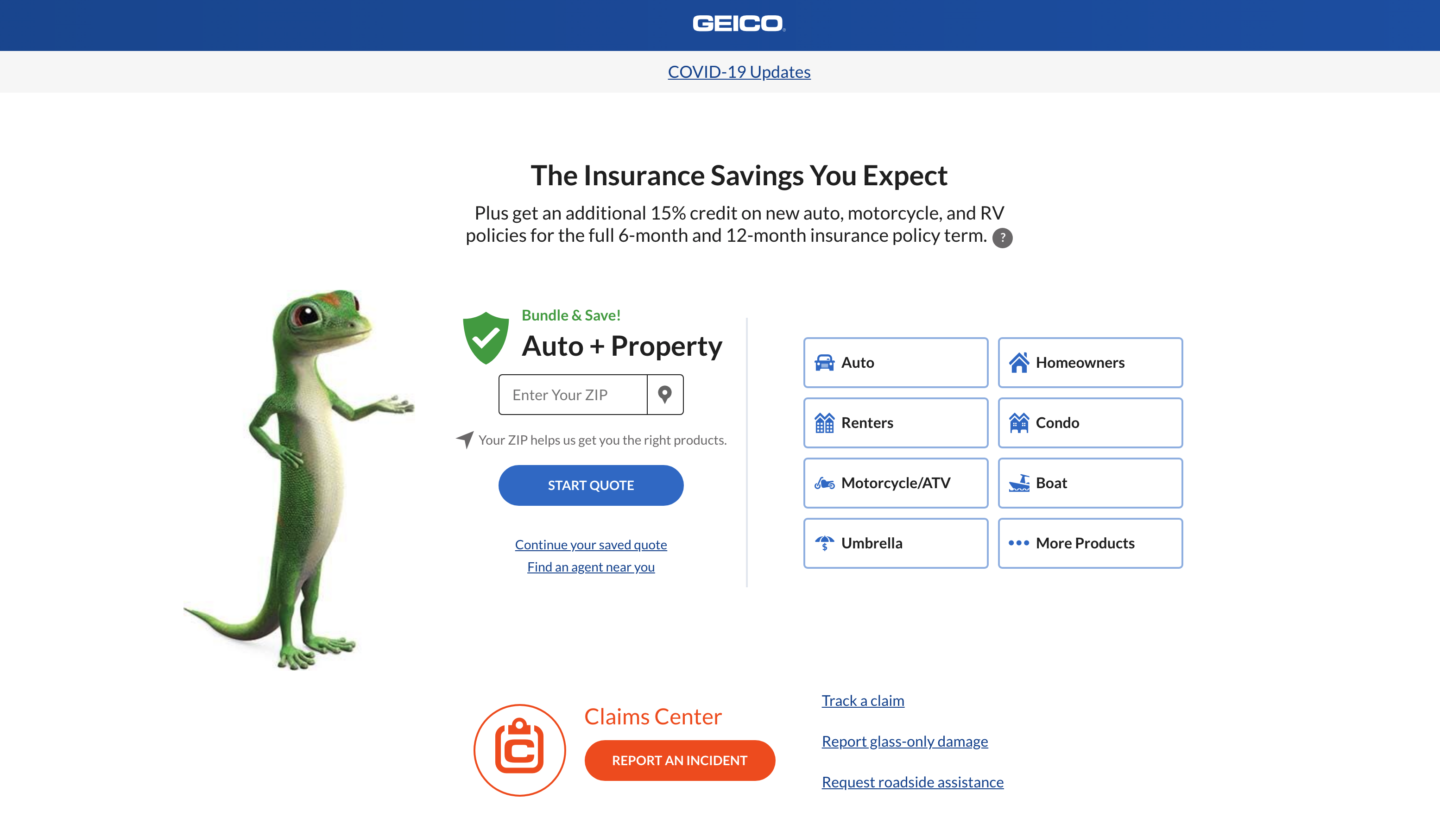

13) Get a Quote for a New Auto and Home Insurance

Getting a car is a great experience. You get to whip around to wherever the horizon takes you. Having insurance coverage while doing this, however, does not have to be expensive.

What we normally do after insuring a car is that we set it and forget about it. Year after year, we get billed without overthinking if there have been any changes with the insurance coverage you may be getting.

This little requote can save you hundreds of dollars as you find out about new policy changes, terms in coverage, and so on. Getting a quote for car and home insurance is simpler than you think.

Some of the top insurance companies:

- State Farm

- Geico

- Progressive

- Allstate

- USAA

- Liberty Mutual

- Farmers Insurance

- Nationwide

- American Family Insurance

- Travelers

14) Do a Makeover of The Lighting in and Around the House

This means changing out your incandescent and fluorescent bulbs to the new age LEDs that cost you more upfront but saves you so much more in the long run. These lights do not heat up as halogens and fluorescents do and can be changed without the fear of breaking in your heads as they are normally made out of plastic.

LEDs are the new kids on the block and have quickly gained in popularity due to their enormous long lifespan and energy-saving benefits.

You can start by pinpointing the places where lights are left on the longest and switch them out with LED bulbs. These could be your porch lights, security lights, and also your living room lights. Move on to your bedrooms next and follow up with the restrooms. For an average use of 3 hours per day, LEDs can last up to 22.8 years!

These changes are only good with proper management of the electricity you consume. This means turning off the lights when not in use. You can learn more about how to become a better environment conscious citizen of this planet.

15) Adopt a Minimalist Lifestyle

Shopping for clothes and keeping up with seasonal trends will only lead you at a loss of your hard-earned labor. Switch to the trending and here to stay lifestyle of minimalism. Not only will minimalism change your life but is good for the planet as well!

Adopting a minimalist lifestyle means reflecting on the needs and wants of your everyday life. If it does not serve a purpose, get rid of it (sell, donate, or recycle).

Going minimal also helps you prevent unwanted spending on the things you would otherwise buy and half-heartedly consume. Reflect on your closet for a second. See things in there you haven’t worn in years? What if you didn’t make that purchase in the first place? That would have saved you money.

Before your next purchase, look back at whether you can fix the item you are thinking of upgrading and replacing. Can it be fixed? Yes? Fix it for a few dollars and give it a longer life. Your wallet will thank you for it.

Minimalism is also referred to as Simple Living. Learn more about it HERE

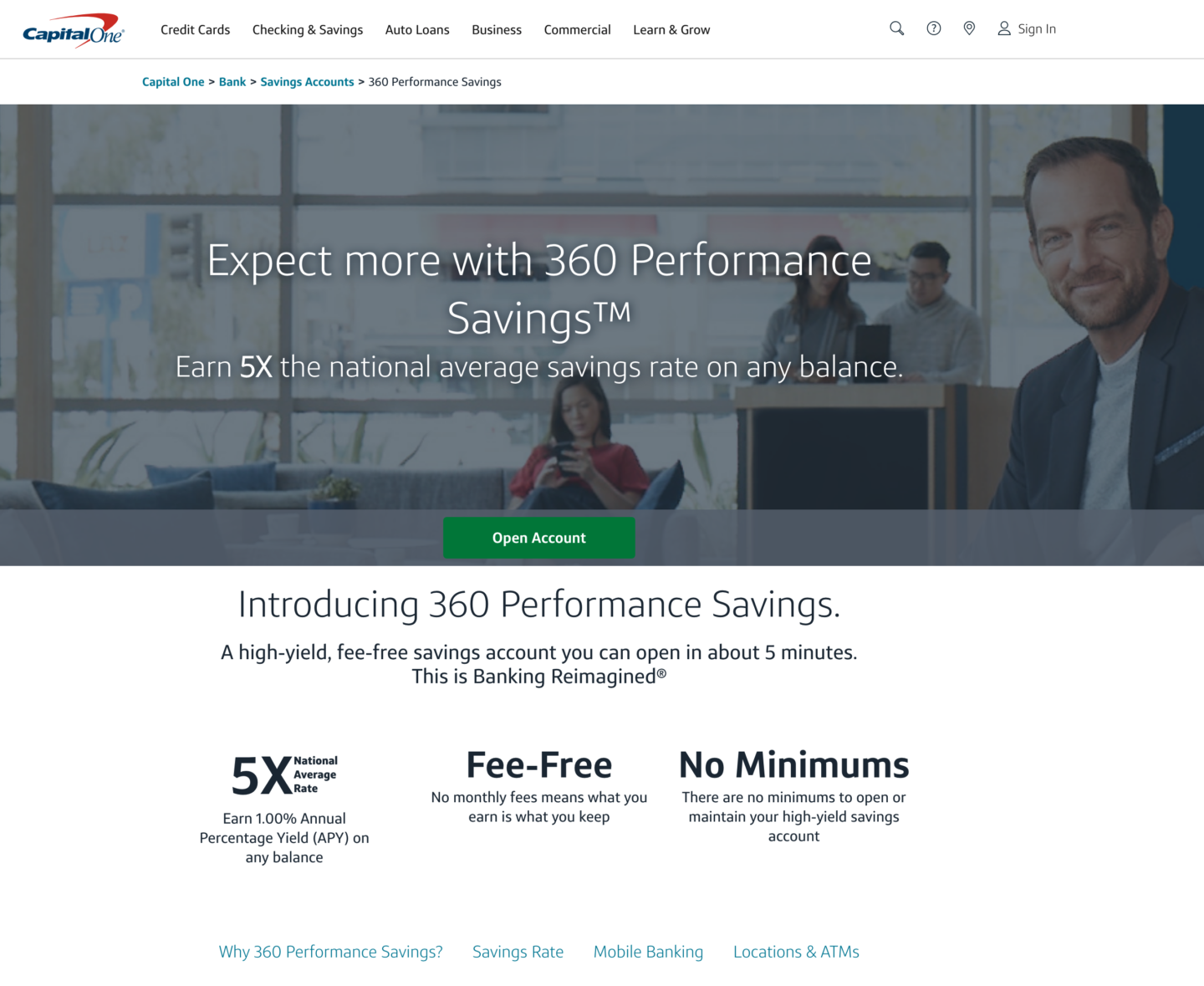

16) Open Up a High Yield Savings Account

Let the money work for you. If you have money saved up, it is best to move it to an account that can pay you back in interest. The higher the APY, the better return you’ll be getting. Most savings accounts provide a measly 0.09% return but we found Capital One 360 Savings account with a yield of 1.00% which is 5x the national average.

They don’t have a minimum account balance so you can essentially start with as little as a dollar.

17) Buy a Water Filter

If you’re a bottled water drinker, you have to admit how costly those 12-24 cases can get. And that’s not including the CRV tax (California only) that’s added at the time of check out. The average person spends around $100 per year on bottled water so getting a water filter for repurposing your home water does not seem like a bad idea at all.

Get yourself a reusable water bottle and you’re good to go.

18) Rent Out Unused Space

If you have an extra room that you are willing to rent out for some money, go for it! Set up an account with Airbnb and start listing away.

We recommend using adequate lighting when shooting for your home. Use a wide-angle lens to get the entire space in one shot and make the room more spacious. If you’d like to know which wide-angle lens and camera we use on our travels, look out for the camera gear section at the bottom of this post.

19) Buy Everyday Use Items in Bulk

Often we have things that we use around the house more often than others. These could be laundry detergent, toilet paper, snacks, etc.

The best approach to saving money is by buying these items in bulk. Snacks often have options of big bags while detergent comes in bigger ounces.

Wholesale stores like Costco and Smart & Final are your best bet in getting items in bulk but you can also find these online if you’re not a member of membership-only stores like Costco. We buy our shampoo and conditioner from Amazon in bulk and saves us so much more in the long run.

Stock up on bulk items as they cost less per ounce which saves you more money!

20) 10-Second Rule

This quick and effective tip helps you fight off those impulse buys and put you on a path to better decision making. Anytime you pick up an item to purchase, hold that thought for 10 seconds and ask yourself whether you really need it or not. Most likely you don’t so better to put the item back on the shelf.

The more you experience these 10 second moments, the better you get at realizing impulse buys. This applies to online purchases as well!

Saving money can be an exciting experience. You not only have more money set aside but you realize how many of these tips actually help the environment as you consume less and become mindful of your actions.

If you follow the 20 tips to saving money FAST in 2020, let us know in the comments section below. Happy Savings!

Check out our recommendations on the top 21 places that are open for travel now. You can maybe save up to visit one of these places!